Did you know...

Good intentions

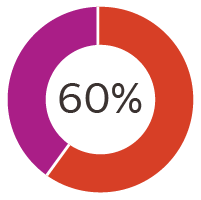

Nearly all Americans (90%) want to align their values with how they use money, and four out of five want to be more intentional about their spending.

“Our values and how we use our money has to line up. It's like your money is your belief system.” — 56-year-old in one-on-one interview

Eager to learn

All generations — young and old — would like to understand new ways of thinking about and managing money.

“I want to have my own money and know how to spend it, without relying on my parents to make those decisions for me. Almost like a freedom.” — 17-year-old in one-on-one interview